Financial Dispute Resolution from 90 days to minutes

How we shrunk financial purgatory from 90 days to 90 seconds

Summary

Dispute resolution from 90 days to 90 seconds

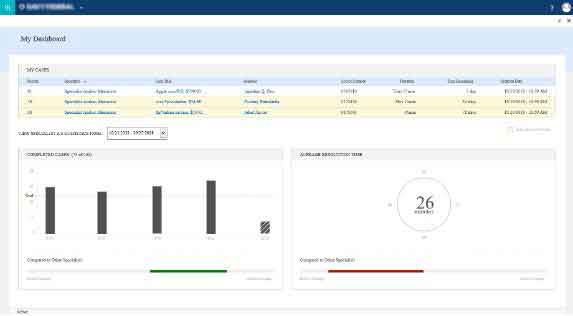

Empowering employees

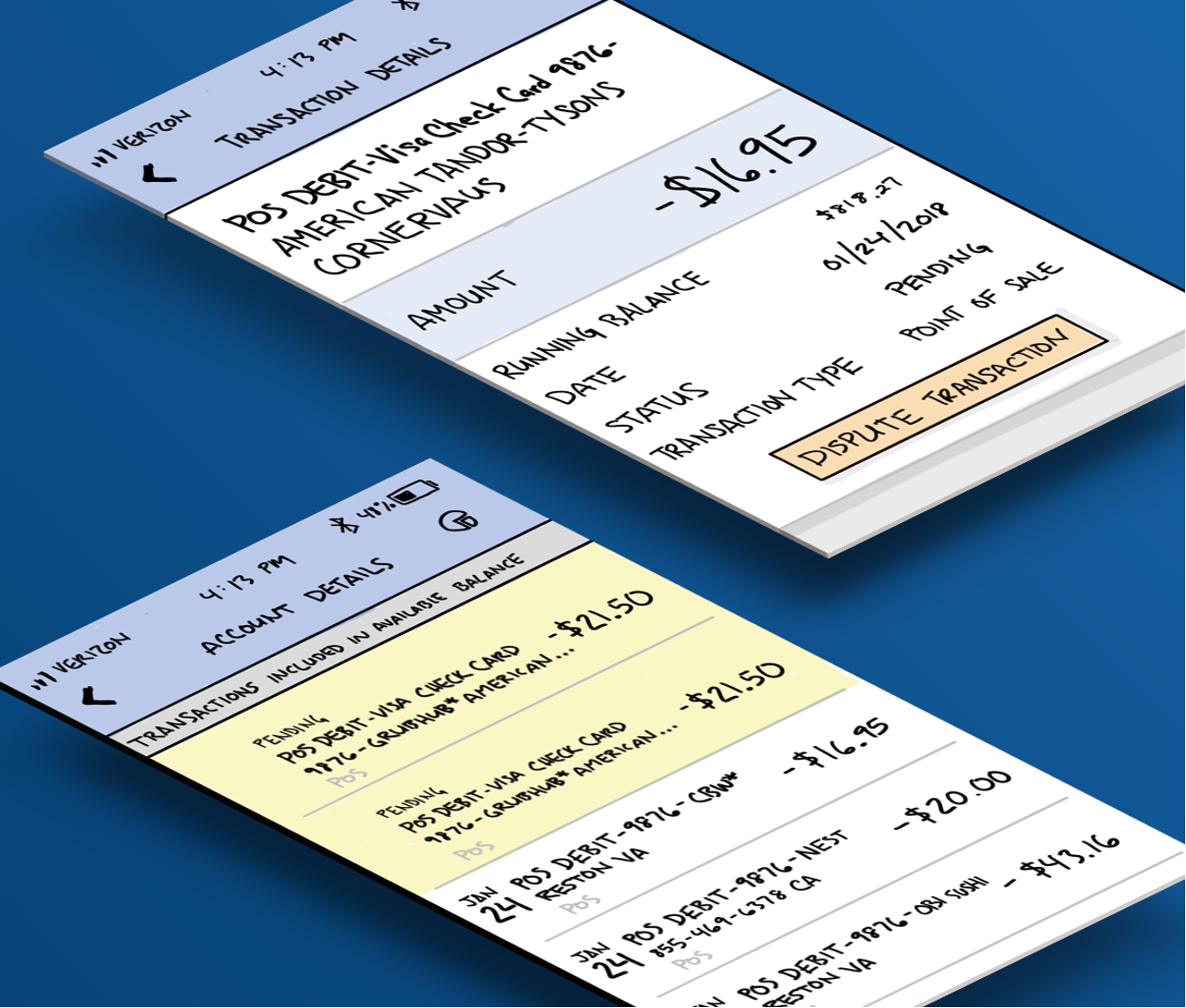

Member self service

$400k annual savings

When I became Director of User Experience working with America's largest credit union, I encountered an outdated problem in our digital age.

Members who discovered unauthorized charges on their accounts were told, "Your dispute will take three months to resolve."

Three months. In a world with instant money transfers and quick loan approvals, this timeline felt outdated. For members living paycheck-to-paycheck, a temporary credit hanging in limbo for 90 days wasn't just an inconvenience, it was disastrous.

This realization sparked the cornerstone project for the credit union's new Digital Labs organization, an experimental arm to accelerate digital transformation focusing on speed, security, and member impact. The journey from identifying the problem to implementing a solution revealed layers of complexity beyond technology.

The Human Cost of Bureaucracy

Imagine a single mother discovers unauthorized charges on her account. She files a dispute via telephone and receives a temporary credit. Life continues. Bills get paid, groceries bought. Then 90 days later, without warning, that credit disappears. The dispute was denied in a letter filled with confusing legal jargon she doesn't understand.

The effects were devastating:

- After 90 days, members watched provisional credits vanish, triggering overdraft fees and difficult choices between necessities like groceries or rent.

- Branch staff were reduced to responding with "I don't know" to urgent member questions.

- Back-office teams are overwhelmed by manual processes that could be automated.

- With every confusing letter, trust in the institution eroded further.

I've spent enough time in financial services to know these aren't just operational inefficiencies. They're moments of vulnerability in people's lives. When your financial institution fails you during a dispute, it doesn't just feel like a process breakdown; it feels like a betrayal of trust.

Peeling Back the Layers

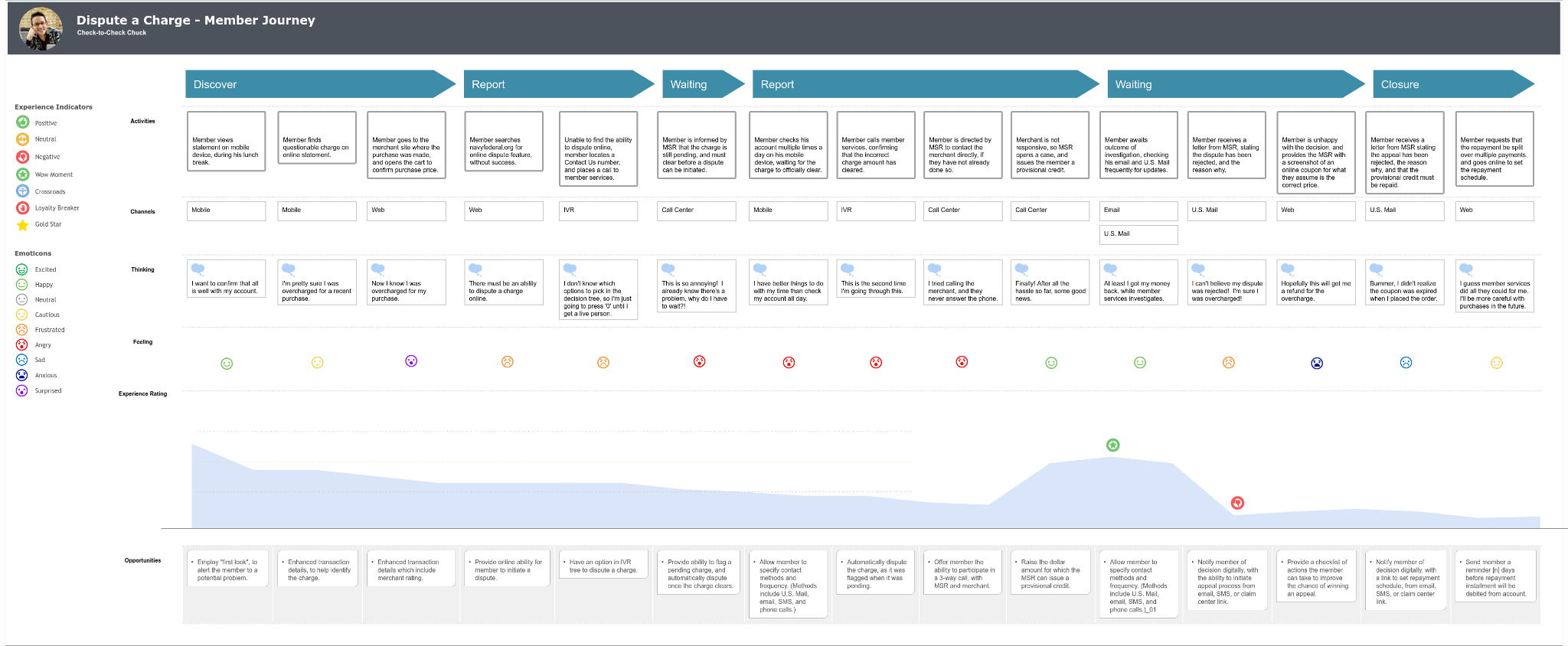

A key lesson I've learned in tackling complex organizational problems is that visible issues often obscure deeper challenges. Our research revealed that the dispute resolution process wasn't just broken—it was fractured across multiple departments communicating differently about the same issues.

Members had no visibility into their disputes or potential impacts. Front-office staff passed along complaints due to their lack of information. Back-office teams spent days on tasks that could’ve been automated. Leadership managed conflicting priorities across separate departments.

The fundamental problem wasn't technological; it was communicational. Members were caught in the middle.

Designing for What Matters

When redesigning financial experiences, I start by asking:

What do people need when something goes wrong with their money? The answer is rarely "more features" and almost always "more control and clarity.

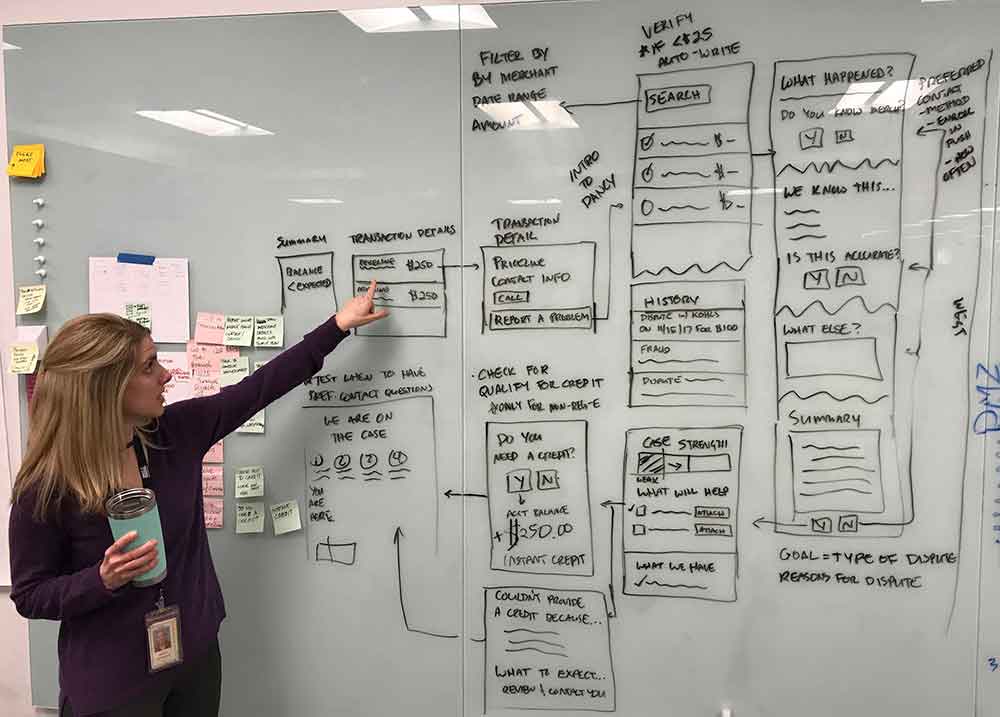

Our solution provided that:

- The ability to file disputes directly through mobile or online banking removes the need for branch visits or phone calls.

- Real-time case status tracking eliminates anxious waiting periods.

- Provisional credits are temporary funds that a financial institution gives you while they investigate a transaction. This means you can access the money right away, even if there’s a question about whether you should have it. If the investigation shows that the transaction was valid, you keep the funds. If not, the money is taken back.

- Clear communication about what is happening and what comes next.

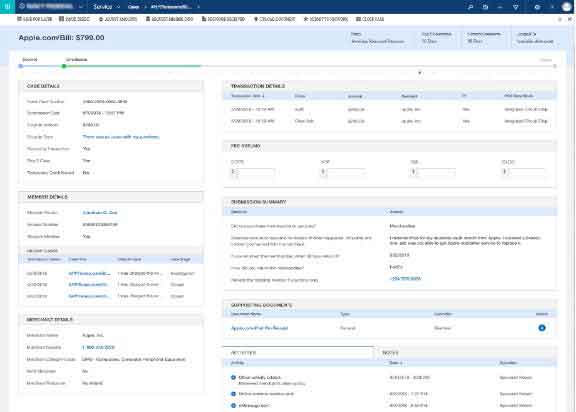

But the member-facing experience was just the beginning. Behind the scenes, we built robust systems that transformed the organization’s dispute handling:

- AI systems detected patterns that human reviewers overlooked.

- Automated workflows managed standard cases without human involvement.

- Smart routing directed complex disputes to the appropriate specialized teams.

- Built-in compliance protection ensured regulatory requirements were fulfilled.

Leading Through the Maze

Have you tried getting legal, IT, operations, and branch leaders to agree on a major process change? I have. It feels like herding cats while juggling chainsaws.

I've found that starting with the human narrative is most effective. I begin with concrete stories about real impacts, not abstract concepts about efficiency or digital transformation:

- The single parent who can't pay rent because their provisional credit vanished.

- The branch employee feels powerless when they can't answer a member's questions.

- The back-office specialist is overwhelmed with processes for automatable cases.

Making the pain personal creates urgency that spreadsheets and PowerPoints can't. It transforms "digital transformation" from a term into a mission.

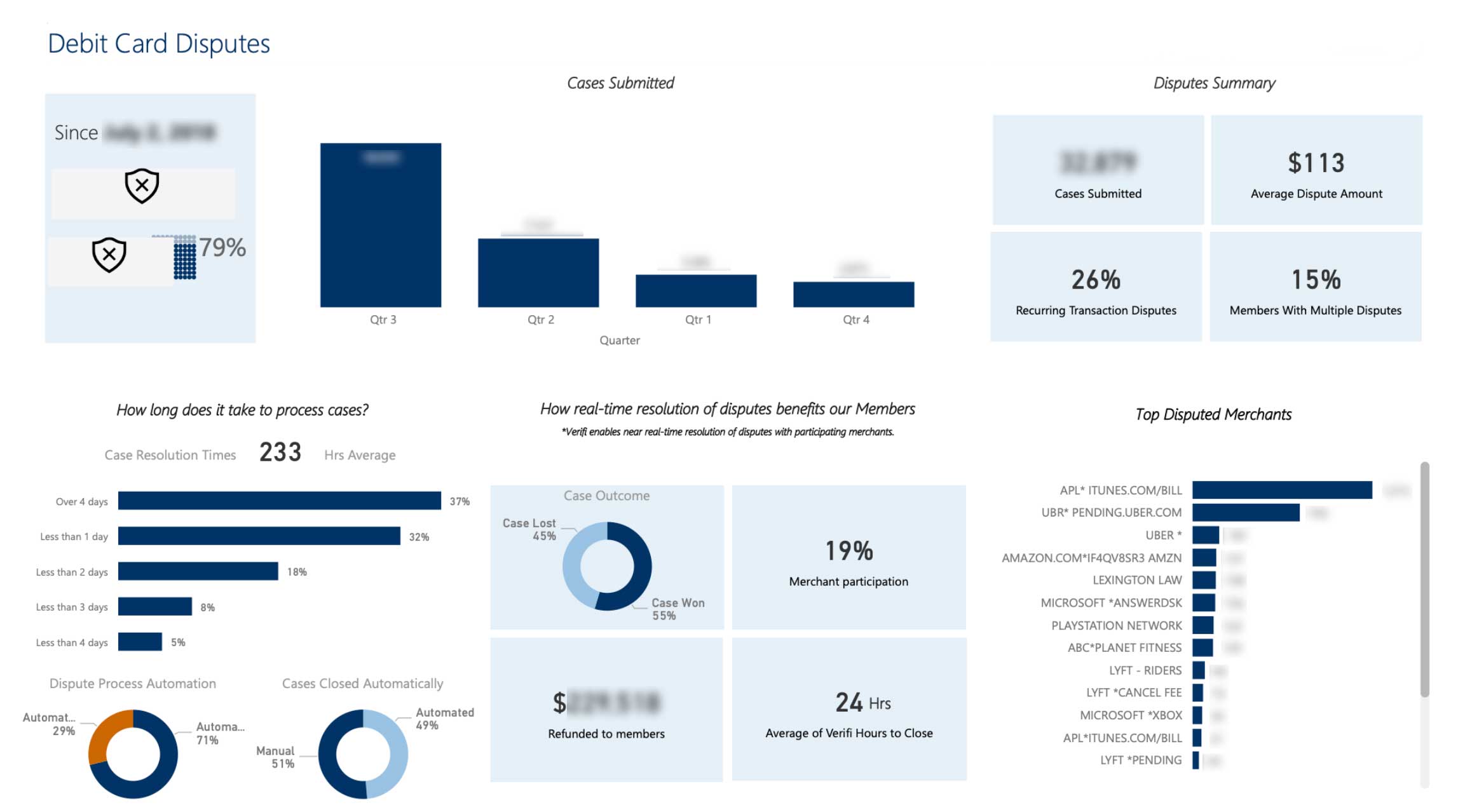

Measuring What Matters

The metrics show that 30% of disputes resolve without human intervention. The organization saves about $400,000 annually. The project won Visa's Excellence in Innovation award.

But the human impact is more substantial:

- Members get answers in minutes, not months.

- Front-office staff feel proud to assist instead of apologizing.

- Back-office specialists can concentrate on complex cases that require personal attention.

- Leadership teams communicate well across departmental boundaries.

Three Essential Truths About Digital Transformation

This project taught me three fundamental truths I apply to every challenge:

1. Technology isn't the solution; it's the enabler.

For simplicity, make it invisible. For oversight, make it visible. The most effective technology disappears except when needed.

2. Change happens on the ground.

One conversation, process, and success at a time. Grand visions inspire, but execution is in the details.

3. Lead with empathy and support with data.

Start with human needs. Validate with evidence. Scale with technology. This sequence is essential.

The success of the project led to the formation of our Digital Labs organization, where we apply these principles to transform other business challenges.

The Path Forward

Want to transform financial services? Stop discussing transformation. Start fixing what's broken step by step.

In my experience, the organizations that progress the most aren't those with ambitious digital strategies, but those willing to confront their members' challenges and systematically address them.

The dispute resolution process was just the beginning. By prioritizing human needs over technology, we've created a template for tackling entrenched operational challenges. The result isn't just better metrics—it's restored trust, empowered employees, and financial peace of mind for the members who need it most.

In financial services, that's what truly counts.